CASE STUDIES / 12. 10. 2023

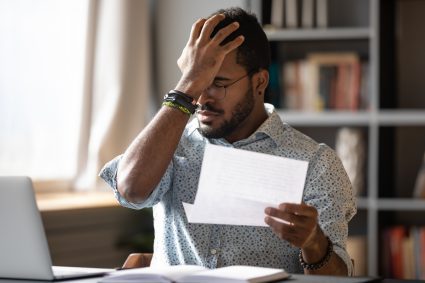

Today we bring you new sad stories of our clients. Fortunately, they always have a good ending. With their input, we want to make you think about whether you are handling your accounting data in their best interests and yours. They are the kind of situations that most ordinary business people would probably not consider...