TAX ADVICE, WORKING WITH DOCUMENTS / 14. 7. 2022

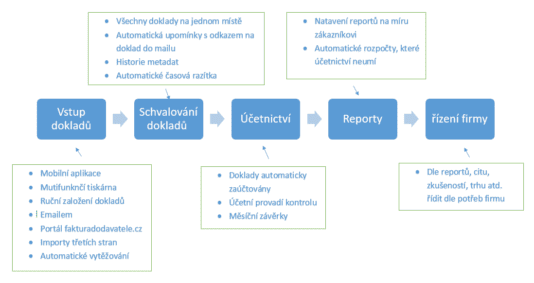

You need different document flows for different sized companies /clients/. For an accounting firm /its employees/ you need a uniform flow. Flow that you can automate, thus reducing the cost of document processing... ISDOC will improve the life of the company, but it won’t save it... You need to have both a combination option and...