TAX ADVICE, TRUSTED ARCHIVE, WORKING WITH DOCUMENTS / 11. 11. 2021

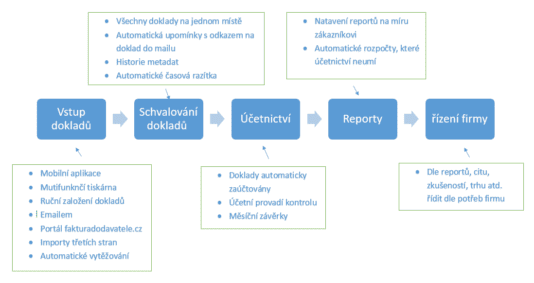

Forget about old accounting books and take a route of perfection and comfort. Thanks to modern technology and innovation in accounting we are able to offer you better and more complex services. Controlling does not depend on people anymore. In cooperation with a system running in the background we are sure that we will not...